HB11 Energy was the focus of a story published in Capital Brief today. The story focused on HB11’s plans to become profitable before Fusion goes mainstream in coming decades. HB11 COO Greg Ainsworth is quoted in the story as saying: “For the first time in Fusion, we have a path to financial return for investors within venture-relevant timescales”. That plan revolves around the laser technology we’re developing and our newly proven fuel fabrication capability.

Here’s a copy of the Capital Brief story by Daniel van Boom, 31 October 2024 …

The Aussie startup betting on fusion energy as Big Tech backs nuclear to power AI boom

Nuclear fusion is still about 30 years away from going mainstream. Australian fusion startup HB11 has a plan to be profitable before then.

American tech titans, scrambling to power AI development, are proving more eager than ever to make bets on unproven energy tech. That may prove great news for one Australian startup.

HB11 Energy is Australia’s first nuclear startup. After five years of R&D to test whether its approach works, COO Greg Ainsworth says it’s now raising a seed round to develop the tech at scale.

Startup seed rounds are typically in the $1 million to $5 million range. “Not in nuclear fusion,” Ainsworth told Capital Brief, days after returning from a trip to Japan and the UAE to speak to potential investors. “We’re raising a few tens of millions, USD.”

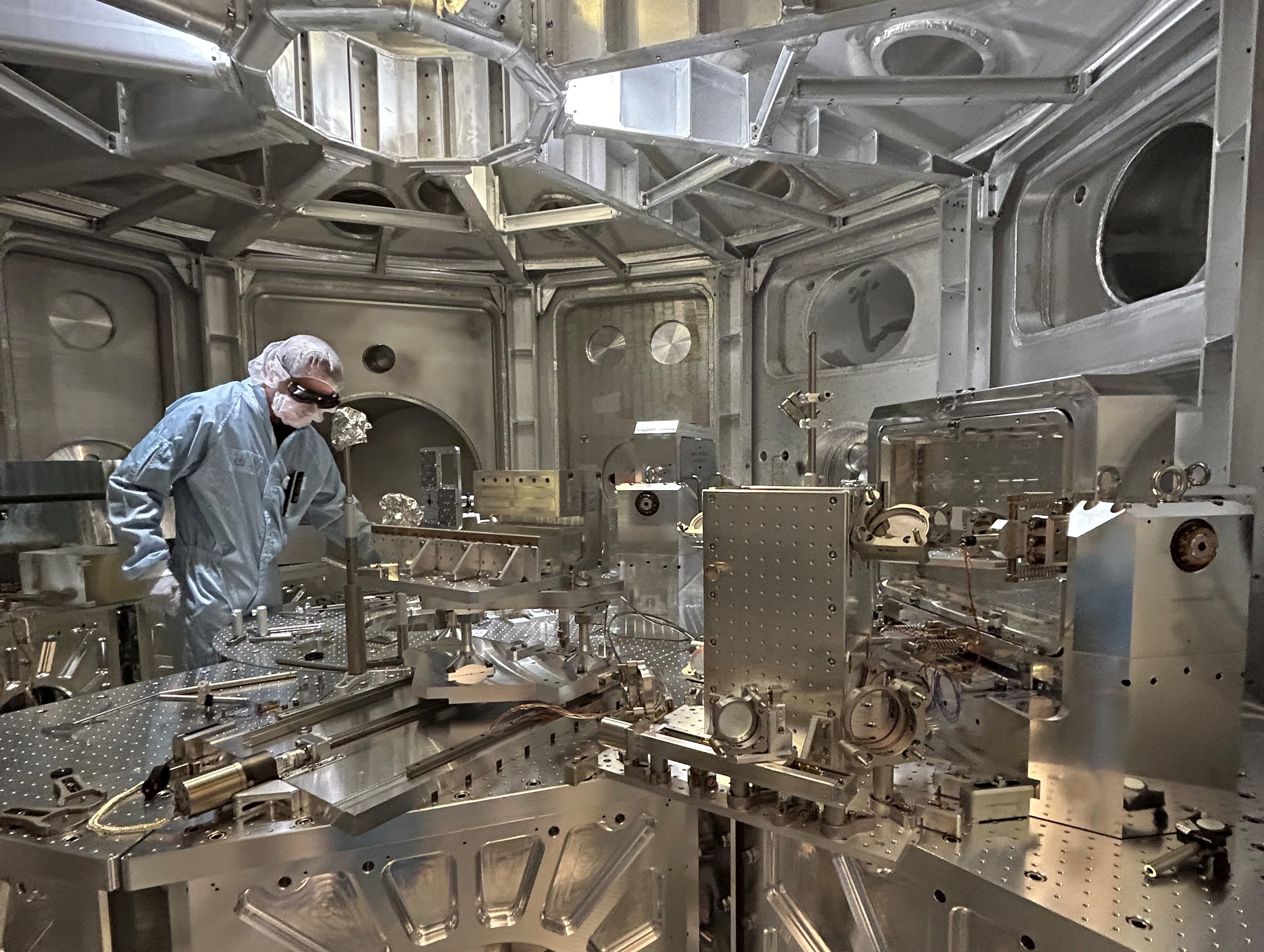

Whereas today’s nuclear plants use nuclear fission to split atoms, fusion proposes the opposite: fusing nuclei together causes bursts of heat and, in turn, generates energy. The Sydney-based startup uses lasers to fuse hydrogen and boron-11 atoms, creating the chemical reaction from which the company gets its name. Ainsworth says the funds it’s raising will be used to develop lasers, the hydrogen-boron fuel pellets they shoot through, and manufacturing facilities to make both.

That will obviously be easier said than done. Nuclear fusion, with its promise of energy that’s bountiful, affordable and non-polluting, h long been something of an atomic white whale. Experts say the tech is real but that it’s still decades away from prime time.

“The standard joke people say is that nuclear fusion is always 30 years away, ” ANU professor Matthew Hole previously said to Capital Brief. “But the reality is, it now probably really is 30 years away.”

It sounds improbable that an Australian startup in such a capital-intensive field could last the decades it will take for its key product reach 1.0 status. But while HB11 is after funding now, Ainsworth says can deliver profits many years before it establishes its first nuclear plant.

That’s thanks to the laser technology it’s developing, which also has applications in medicine, just with about “a trillion, trillion times less energy”, and resource exploration. Most significant is its use by militaries, where it’s known as “directed energy” – essentially a laser beam. HB11 won a $22 million grant from the Australian government in 2022 for that purpose.

“We have a path to financial return for investors within venture relevant timescales for the first time in fusion” Ainsworth said. “But more importantly, we’ve got all these other groups, powerful groups, who are in their own races and also have deep pockets demanding performance improvement in laser fusion.”

Ainsworth says Australia has all the research and manufacturing abilities to develop the required laser technology domestically, with Adelaide a hotbed in particular. Whether the company remains based in Australia depends on where its investors are located, however.

Local founders often complain that overseas investors have a mu greater interest in deep tech than Australian ones, despite the country’s impressive research credentials.

International appetite for fusion is clear – last week a one-year-old Californian startup called Pacific Fusion exited stealth mode announcing it had raised US$900 million ($1.3 billion) in a Series A. Individual investors on the cap table include Stripe founder Patrick Collison, former Google CEO Eric Schmidt and Australia’s own Andrew Forrest.

The interest is understandable. With renewable energy evidently unable to shoulder the expected energy weight of artificial intelligence Google has struck a power purchasing agreement with small-modular nuclear company Kairos Power, while Microsoft has done the same with X-Energy – even though both of their reactors are still unproven at scale.

That demand for power is likely to continue growing for decades, meaning greater opportunity for companies like HB11, even if they’re still many years away from proving their technology works.

“The amount of power we’re going to need is going to stun people,” said Ben Sand, whose Strong Compute startup optimises cloud services for AI development. “Yes, chips are becoming more efficient, but that always been happening. Our demand for what chips can do has always gone up faster than the efficiency of chips.”

“Weʼre using more power than we ever have on compute, and thatʼs going to continue.”